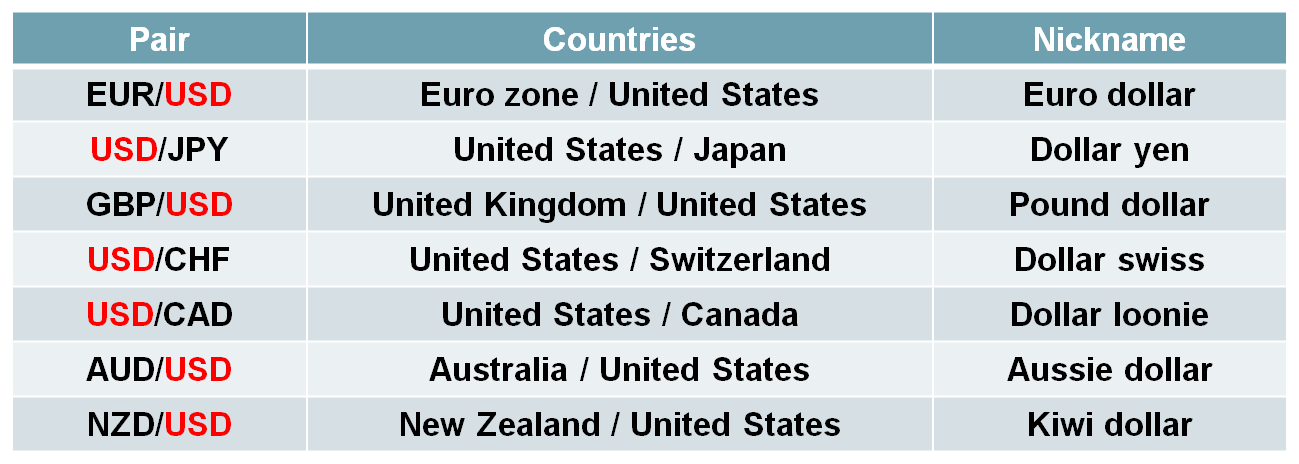

Learn about currency pairs in the forex market.

The forex market is an international market where foreign currencies are traded. Currency pairs vary in terms of strength, trading volume, and the economic effects associated with them.

The currency code consists of 3 letters, with the first two letters representing the country name, and the last letter representing the currency.

For example, USD represents the United States of America, with the letter D representing the currency, which is the dollar.

In this article, we will explore the types of major, minor, and cross-currency pairs traded in the forex market:

Most Famous Currencies:

EUR/USD:

The EUR/USD pair, Euro against the US dollar, is suitable for various types of traders, including day traders and long-term investors. Trading this pair provides opportunities for profit through technical and fundamental analysis, as it is affected by various economic factors such as economic growth, monetary policy, and global events.

The EUR/USD pair provides strong and reliable trading signals, making it easier for traders to make informed trading decisions. However, it requires careful study and analysis of daily fluctuations and economic news to succeed in trading this pair.

USD/JPY:

The USD/JPY pair, the US dollar against the Japanese yen, is one of the prominent currency pairs in the forex market. It is among the major pairs traded by investors and traders worldwide. It is characterized by high trading activity and liquidity, providing diverse profit opportunities.

GBP/USD:

GBP/USD, also known as “the cable,” is named after the submarine cables that were previously used to transmit bid and ask prices between the exchanges in London and New York across the Atlantic Ocean.

This nickname signifies the rich history and past of this pair. Trading the GBP/USD pair shares many similarities with trading the EUR/USD pair, despite the UK never being part of the Eurozone. However, the British economy is closely linked to the European Union.

It is worth noting that the monetary policies of both countries, including the Bank of England and the Federal Reserve, have a significant impact on the performance of the GBP/USD pair.

Commodity Currencies:

AUD/USD:

Australian and New Zealand dollars are typically referred to as “commodity currencies” due to the significant role played by natural resources in the economies of these countries. Regarding the AUD/USD pair, the focus is mainly on key sectors such as mining, cattle farming, wool industry, and wheat cultivation.

Therefore, commodity prices can greatly impact the movement of the AUD/USD pair, along with interest rate decisions made by the Reserve Bank of Australia. The Reserve Bank of Australia generally adopts higher interest rates compared to some other central banks, which can also influence the movements of the AUD/USD pair.

USD/CAD:

Movements in the Canadian dollar (CAD) are heavily influenced by commodity prices due to Canada’s abundant natural resources, such as lumber, natural gas, and oil. Canada is the second-largest country in the world in terms of land area, making it highly dependent on its natural resource sector in its economy.

However, the USD/CAD pair faces a unique challenge as the performance of the Canadian dollar is closely tied to the performance of the US economy. Therefore, in secondary pairs like the EUR/CAD, the performance of the Canadian dollar may be similar to that of the US dollar. But when it comes to the USD/CAD pair, it becomes difficult to predict price movements due to this close correlation.

forex market