Forex Market Trading Hours and Peak Sessions

The forex market allows traders to trade 24 hours a day, 5 days a week, during trading sessions that align with the opening hours of stock markets in different parts of the world.

Definition of Forex:

Forex trading involves the buying and selling of currencies, commodities, and indices. It operates 24 hours a day, 5 days a week (24/5), and the trading volume and market activity vary depending on the opening hours of financial markets in different regions around the world.

The forex market enables traders to trade at any time during the market’s working hours. You can open and close trading positions within a few hours or even less (day trading), or you can leave them open for several days (long-term trading), depending on your preferences and trading strategy.

Market Hours:

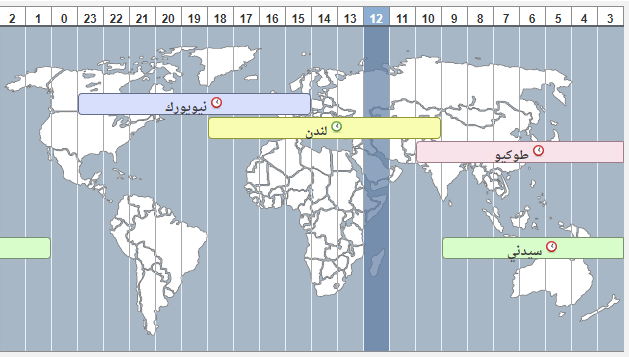

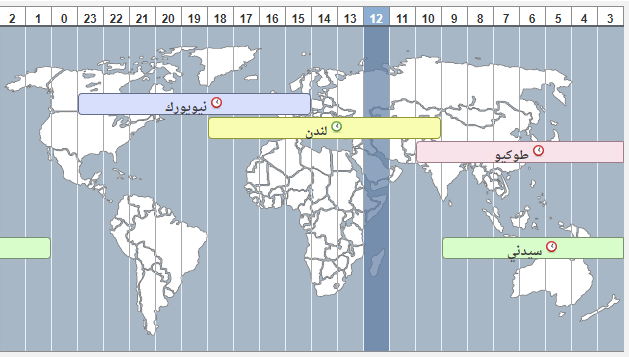

Trading sessions start in Australia and New Zealand, then shift to Asia, followed by the opening of trading sessions in Europe, and finally, the U.S. trading market opens. This is based on Greenwich Mean Time (GMT+2) as a global reference time.

Australian Trading Session (Sydney): Starts at 22:00 and ends at 07:00 (GMT+2) during daylight saving time. In standard time, it starts at 21:00 and ends at 06:00.

Asian Trading Session (Tokyo): Starts around midnight at 01:00 and continues until 10:00 (GMT+2) during daylight saving time. In standard time, it starts at 00:00 and ends at 09:00.

European Trading Session (London): Lasts for nine hours from 08:00 to 17:00 (GMT+2) during daylight saving time. In standard time, it starts at 07:00 and ends at 16:00.

North American Trading Session (New York): Starts at 14:00 and ends at 23:00 (GMT+2) during daylight saving time. In standard time, it starts at 13:00 and ends at 22:00.

Please note that these times are based on Greenwich Mean Time (GMT+2), and the local timing in each country may vary based on local time and daylight saving periods.

The Importance of London and New York Sessions:

The time period from the start of the London session until the end of the New York session is popular among traders due to the high market activity during this period. There are significant opportunities to profit from the high price volatility and the large liquidity available.

However, it’s important to note that between 19:00 and 22:00 (GMT+2), the market activity is generally lower, and price volatility decreases due to the overlap of trading hours in different global markets and a reduced number of active traders.

It’s also important to consider the changes in Daylight Saving Time (DST), where time is adjusted by adding or subtracting one hour in the spring and fall, respectively. This may affect the timing of trading sessions.

Commodity and Index Trading Hours:

Trading times for different financial instruments vary based on the type of asset. Here is a schedule to illustrate the trading hours for some common financial instruments:

Forex (Currency Pairs):

Trading forex pairs is available throughout the week from Monday to Friday.

Trading usually opens around 00:00 (GMT+2) or near that time.

Trading usually closes around 23:59 (GMT+2) or near that time.

Changes in timing should be considered based on daylight savings and standard time adjustments.

Precious Metals (such as Gold and Silver):

Gold (XAUUSD) and Silver (XAGUSD) can be traded throughout the week from Monday to Friday.

Trading usually opens around 01:00 (GMT+2).

Trading usually closes around 23:55 (GMT+2).

Oil and Gas:

Crude oil (XBRUSD), West Texas Intermediate (XTIUSD), and Natural Gas (XNGUSD) can be traded throughout the week from Monday to Friday.

Trading usually opens around 01:05 (GMT+2).

Stocks:

Trading hours for U.S. stocks depend on the exchange they are listed on and generally range from 16:30 to 23:00 (GMT+2).

Trading hours for UK and German stocks depend on the exchange they are listed on and generally range from 10:00 to 18:30 (GMT+2).

Please note that these schedules are subject to change and may vary based on daylight saving time adjustments and other events.

As for the U.S. indices, here is a timetable indicating trading hours for different financial instruments:

U.S. Indices:

US500: From 01:05 to 23:15 Monday to Thursday, and from 23:30 to 23:55 on Friday.

US100: From 01:05 to 23:15 Monday to Thursday, and from 23:30 to 23:55 on Friday.

US30: From 01:05 to 23:15 Monday to Thursday, and from 23:30 to 23:55 on Friday.

FTSE 100 (UK100): From 01:05 to 23:15 Monday to Thursday, and from 23:30 to 23:55 on Friday.

Nikkei 225 (JP225): From 01:05 to 23:15 Monday to Thursday, and from 23:30 to 23:55 on Friday.

ASX 200 (AU200): From 02:55 to 09:25 Monday to Thursday, and from 10:15 to 23:55 on Friday.

Hang Seng (HK50): It opens three times a day: from 03:20 to 05:55, from 07:05 to 10:25, and from 11:20 to 18:55.

It’s worth noting that the cryptocurrency market operates 24/7 and is not tied to the forex market trading hours.

Advantages of the Forex Market:

Thanks to the high liquidity in the forex market, traders can execute trades instantly and easily at any time, even during non-regular working hours. Additionally, traders can take advantage of market news and events during unofficial working hours, providing them with an opportunity to respond to immediate market changes.

Despite the availability of trading opportunities 24/5, some assets may be more active during specific time periods. For example, the EUR/USD currency pair may experience higher activity during the European and American trading sessions, while the AUD/USD pair may be more active during the Australian and Asian trading sessions.

Volatility in the Forex Market:

In the forex market, currency prices fluctuate constantly due to changes in supply and demand. When the demand for a particular currency increases, its value rises against other currencies due to increased buying power. Conversely, when the supply of a currency exceeds the demand for it, its value decreases against other currencies due to selling pressure.

These price fluctuations are influenced by multiple factors such as economic and political events, market sentiment, interest rate expectations, and other factors.

These price fluctuations provide traders with an opportunity to profit by buying low and selling high, making the forex market attractive to many traders.

In summary, the forex market trading has high liquidity and allows traders to trade 24 hours a day, 5 days a week, which aligns with the opening hours of stock markets in different parts of the world. The major trading sessions are the Australian, Asian, European, and North American sessions, with trading in London and New York being the most active.